By Neil Munro

Congressional talks over border security and the wall have stalled because Democrats are trying to sharply limit the deportation of economic migrants.

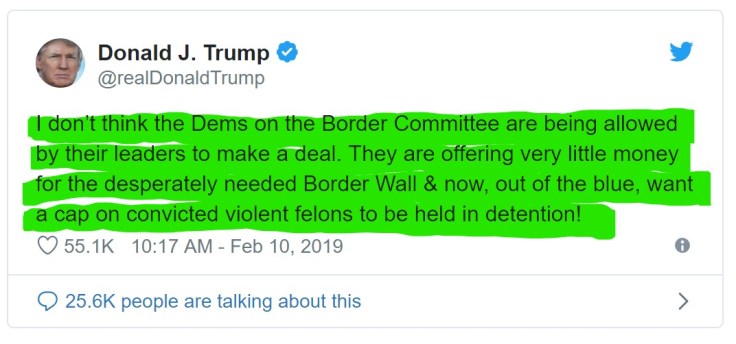

President Donald Trump posted a tweet on Sunday about the partisan divide over deportation rules which have split the 17 legislators drafting the 2019 budget for the Department of Homeland Security:

The “cap on convicted violent felons to be held in detention” likely refers to the Democrats’ push to shrink the number of detention spaces needed by the U.S. Immigration and Customs Enforcement (ICE) agency to hold migrants during the legal deportation process.

The Washington Post reports:

Democrats were trying to limit the number of detention beds that the U.S. Immigration and Customs Enforcement agency would have access to. Democrats want to cap detention beds as a way to limit aggressive detention activities by ICE.

The cap on detention beds would not “Abolish ICE,” as sought by some Democratic legislators, but would shackle ICE to the establishment’s pro-migration policies.

ICE needs many detention beds because judges and migrants’ lawyers try to stretch out the time needed to deport each migrant. Many of the lawyers are progressive ideologues who oppose any deportations. So if the progressive lawyers double the time needed to deport each migrant, they also halve the number of migrants who get deported.

If the Democrats can shrink the number of detention beds, then enforcement officials would be unable to deport many lower-priority economic migrants. That would create a hidden amnesty for economic migrants who do not commit violent crimes.

Officials normally put a higher priority on deporting violent criminals illegals, and illegals caught driving while drunk. But many of the criminal migrants are aided by lawyers eager to slow deportations.

Also, without enough beds, border agencies would be forced to catch-and-release the wave of Central American migrants seeking jobs in Democrat-run cities.

Currently, officials do not have the enforcement agents and bed spaces needed to catch, detain, and deport migrants crossing the border, or even the one million migrants already ordered home by judges.

Trump requested funding for 50,000 beds in 2019. Democrats want to push the number down below 30,000, and add rules to reduce the detention of migrants already living in the United States and of migrants who bring children into the United States.

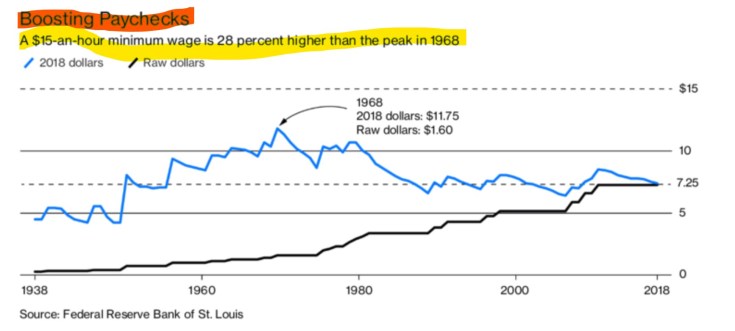

There are at least 11 million migrants in the United States, including roughly 8 million who are working. That illegal population is a huge benefit to business because the migrants force down wages, boost rental costs, and raise consumer sales. The population is also a huge problem for the many millions of Americans who earn less at their jobs and pay more for apartments.

Investors, employers, and Democratic political candidates already get huge benefits from the huge population of 45 million legal immigrants.

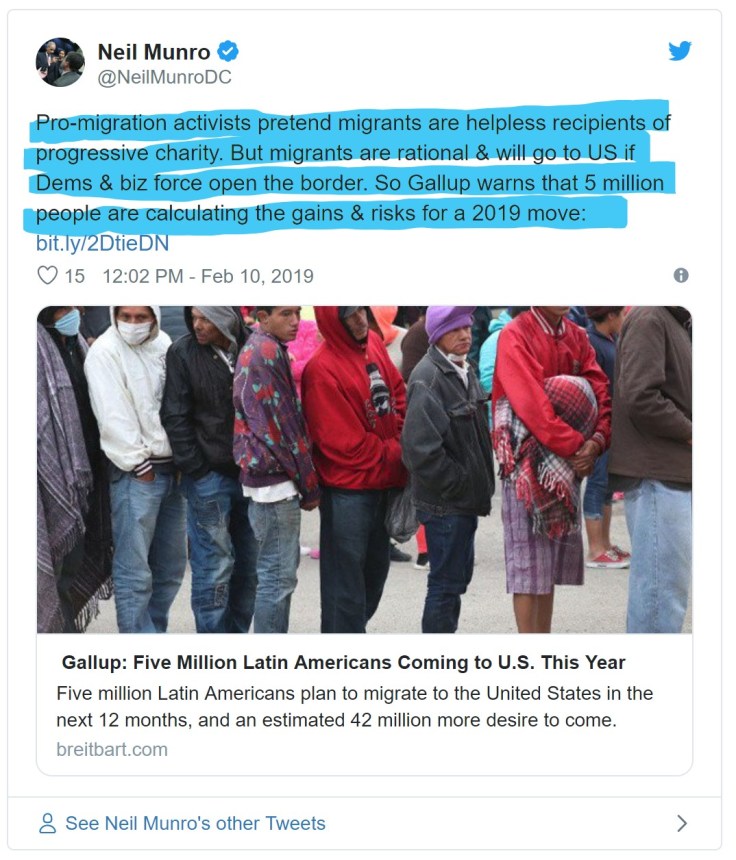

The disagreement over deportations comes as the Gallup polling company reported that 5 million people to the south of Texas are considering whether to migrate this year into the United States:

Budget talks are taking place behind closed doors, but each side is leaking claims about the disagreements. The Wall Street Journal reported:

A Democratic aide said that if Democrats agree to a number above that, they will want concessions on their priorities, such as the number of detention beds and asylum rules.

…

Lawmakers haven’t agreed on the number of detention beds for Immigration and Customs Enforcement. Democrats are pushing for a lower number, believing that it would limit how many people that ICE could detain, while Republicans want a higher number, saying it is for humanitarian reasons to process asylum claims.

“I think the talks are stalled right now,” said GOP Sen. Richard Shelby, who is a member of the 17-person panel which is supposed to draft a 2019 spending plan for the Department of Homeland Security (DHS). “I’m not confident we’re going to get there.” The plan was supposed to be completed by February 11, before a February 15 vote.

The Republicans on the DHS panel include Alabama Republican Sen. Richard Shelby, West Virginia Sen. Shelley Moore Capito, North Dakota Sen. John Hoeven, Missouri Sen. Roy Blunt, Texas Rep. Kay Granger, Tennesee Rep. Chuck Fleischmann, Georgia Rep. Tom Graves, and Mississippi Rep. Steven Palazzo.

The Democrats are Vermont Sen. Patrick Leahy, Illinois Sen. Richard Durbin, Montana Sen. Jon Tester, New York Rep. Nita Lowey, California Rep. Lucille Roybal-Allard, North Carolina Rep. David Price, California Rep. Barbara Lee, Texas Rep. Henry Cuellar, and California Rep. Pete Aguilar.

The establishment’s economic policy of using legal and illegal migration to boost economic growth shifts enormous wealth from young employees towards older investors by flooding the market with cheap white-collar and blue-collar foreign labor.

That annual flood of roughly one million legal immigrants — as well as visa workers and illegal immigrants — spikes profits and Wall Street values by shrinking salaries for 150 million blue-collar and white-collar employees and especially wages for the four million young Americans who join the labor force each year.

The cheap labor policy widens wealth gaps, reduces high tech investment, increases state and local tax burdens, hurts kids’ schools and college education, pushes Americans away from high tech careers, and sidelines millions of marginalized Americans, including many who are now struggling with fentanyl addictions.

Immigration also steers investment and wealth away from towns in Heartland states because coastal investors can more easily hire and supervise the large immigrant populations who prefer to live in coastal cities. In turn, that coastal investment flow drives up coastal real estate prices and pushes poor U.S. Americans, including Latinos and blacks, out of prosperous cities such as Berkeley and Oakland, California.