NO SURPRISE over McCain’s Role in Trump Dossier Smear–Top Staffer was Involved in IRS Scandal!

Published on Mar 18, 2019

Last year, Judicial Watch released newly obtained internal IRS documents, including material revealing that Sen. John McCain’s former staff director and chief counsel on the Senate Homeland Security Permanent Subcommittee, Henry Kerner, urged top IRS officials, including then-director of exempt organizations Lois Lerner, to “audit so many that it becomes financially ruinous.”

Southern Poverty Law Center Amasses $518M War Chest, $121M Now Offshore

By Chris Menahan

The Southern Poverty Law Center is fabulously wealthy and getting richer and richer by the year according to their latest tax forms.

From the Free Beacon:

The Southern Poverty Law Center (SPLC), a far-left nonprofit known for its “hate group” designations, has surpassed a half billion dollars in total assets and now has $121 million parked offshore, according to the group’s most recent financial statements.

[…]According to the filings submitted to California’s Office of Attorney General, the group reported total assets of $518 million from November 2017 to the Oct. 31, 2018, an increase of $41 million from the $477 million in total assets it reported on its previous year’s tax forms.

The SPLC’s assets increased despite its total revenue falling by $15 million last year. The SPLC hauled in $136 million in total revenue throughout 2017. This number fell to $121 million in 2018. Its contributions and grants also fell by more than $20 million from 2017 to 2018, from $132 million to $111 million.

Despite the fall in revenue, the SPLC’s vast investment portfolio expanded in 2018, which included a drastic increase in the amount of money it has parked overseas. By the end of 2018, its non-U.S. equity funds rose to $121 million, an uptick of nearly $30 million from the $92 million it had parked in offshoreinvestments throughout 2017.

The SPLC pushed the Jussie Smollett story:

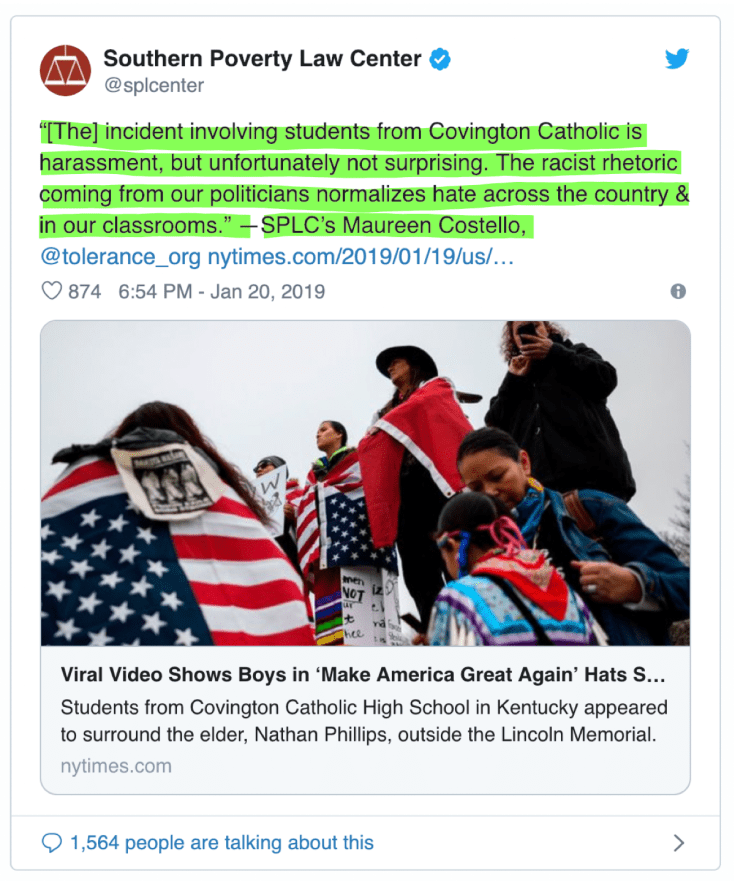

They also pushed the Covington Catholic hoax:

“Fighting hate” is big business.

MEDIA MATTERS PRESIDENT’S DEROGATORY, HATEFUL COMMENTS EXPOSED

Rank hypocrisy of far-left activist brought to light

MARCH 14, 2019

Media Matters president and far-left activist Angelo Carusone is under fire after The Daily Caller unearthed hateful and inflammatory comments he made in the past about everything from transvestites to ethnicity.

Carusone has been leading a campaign against Fox News host Tucker Carlson for things he said on a radio program several years ago. Sensing hypocrisy, Daily Caller reporter Peter Hasson uncovered an old blog in which Carusone allegedly used hateful rhetoric against a series of groups.

“Carusone’s now-defunct blog included degrading references to ‘trannies,’ ‘jewry’ and Bangladeshis,” Hasson wrote. “Carusone posted a lengthy diatribe in November 2005 about a Bangladeshi man who was robbed by ‘a gang of transvestites,’ as Carusone described it. Carusone was offended that the gang was described as ‘attractive’ in an article.”

The Daily Caller – which was co-founded by Carlson – posted screen images of Carusone’s alleged old blog. The report also indicated the Media Matters honcho also “downplayed a male basketball coach’s alleged sexual and physical abuse of his female players” and used an ethnic slur.

The Daily Caller report also indicated that Carusone allegedly made anti-Semitic comments about his then-boyfriend and once praised then-West Virginia Sen. Robert Byrd, a Democrat and former high-ranking member of the Ku Klux Klan, as one of his favorite public figures, writing: “In his lunacy, we trust.”

THIS IS CNN? PRIMETIME SHOWS FILLED WITH LIBERAL OPINION, NOT STRAIGHT NEWS AS NETWORK CLAIMS

“In another post, Carusone claimed that his boyfriend only leaned conservative ‘as a result of his possession of several bags of Jewish gold,’” Hasson wrote. “Carusone previously dismissed concerns about his past anti-Semitic comments on the grounds that his longtime partner is Jewish.”

Media Matters did not immediately respond to a request for comment.

Media Matters is known as a tax-exempt lobbying organization which has aimed to silence many conservative media voices. Carusone has led numerous boycott attempts but famously opted against taking action after hateful rhetoric from MSNBC host Joy Reid’s pre-fame blog was unearthed.

In addition to Carusone’s old comments making headlines, Carlson also has hit Media Matters over its non-profit status.

“In its original tax application to the IRS, Media Matters claimed that the American news media were dominated by a pro-Christian bias and that they were needed to balance it. Despite the obvious absurdity of this claim, the group received non-profit status. It has been violating the terms of that status ever since,” Carlson said on Tuesday night.

As voice after voice gets purged from social media, still think there’s no censorship?

For a civilization that considers freedom of speech one of its fundamental principles and universal human rights, the West sure does a lot of censorship – and no, farming it out to ‘private companies’ does not change what it is.

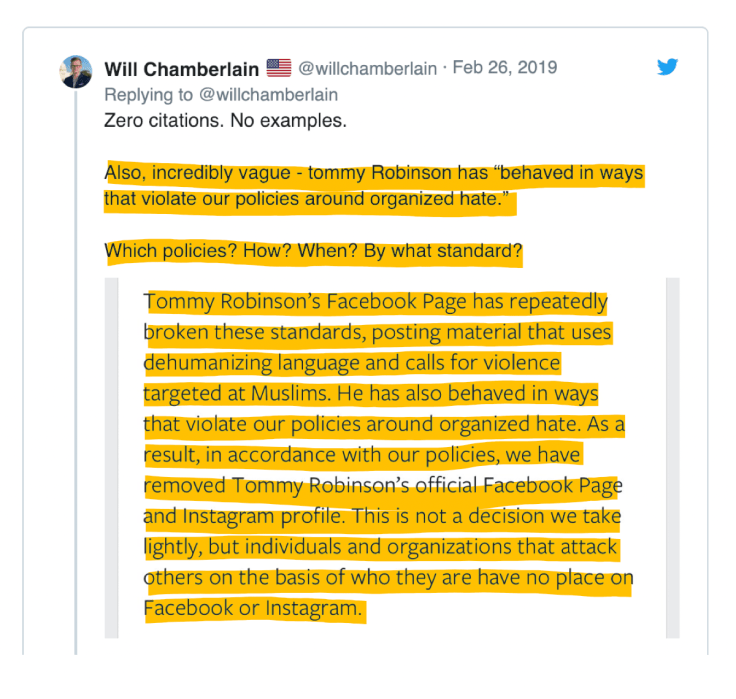

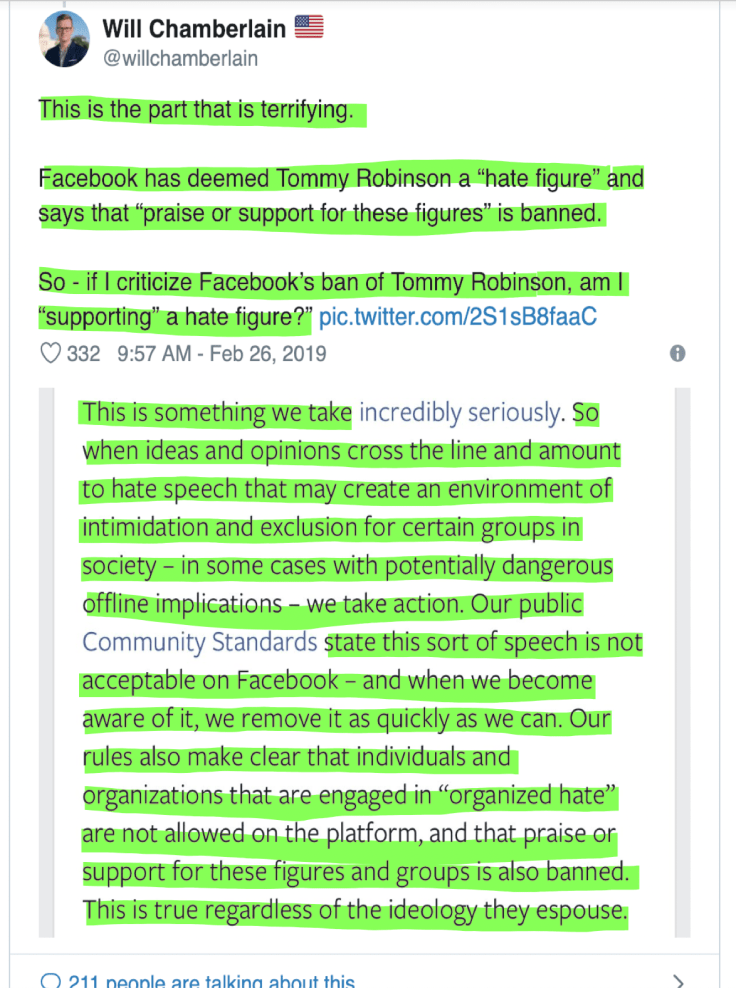

It happened again on Tuesday: British activist Tommy Robinson was erased from Facebook and Instagram. The social media behemoth said it has to act “when ideas and opinions cross the line and amount to hate speech that may create an environment of intimidation and exclusion for certain groups in society.”

As online polemicists are fond of saying, “citation needed!” Yet Facebook offers none: no evidence of specific violations, not even a definition of “hate speech,” just an arbitrary standard – and a threat of further bans for people who “support… hate figures.” Whatever that means.

How did journalists – those paladins of free speech, the fabled Fourth Estate, the valiant protectors of values that would die in darkness without their intrepid efforts – greet this news? Did they object to a British citizen being muzzled and wax about the dangers to digital democracy? Oh no, they rejoiced: Finally, what took so long?!

The same process repeated itself later in the day, when Twitter banned Jacob Wohl. The self-described supporter of US President Donald Trump had reportedly boasted about setting up fake accounts to influence the 2020 election. That is regarded as the sin-above-all-sins by social media executives, terrified of Congress blaming them for Hillary Clinton losing the White House to Trump in 2016, even though 99 percent of US media considered it rightfully hers.

Here’s the thing, though: Twitter still hasn’t banned Jonathon Morgan, CEO of New Knowledge, a company that was proven to have set up thousands of fake accounts to swing the Senate race in Alabama to the Democrats, and later paid by the Senate to blame Russia for its tactics.

Let’s also remember the suspension of several Facebook pages belonging to Maffick Media, an outfit that partners with Ruptly, a RT subsidiary. After the “Twitter police” at the German Marshall Fund and CNN raised a fuss about these pages having “Kremlin ties,” Facebook blocked them until they agreed to put up a notice about being “funded by Russia.”So they did, even though there is no such rule that would be universally applied.

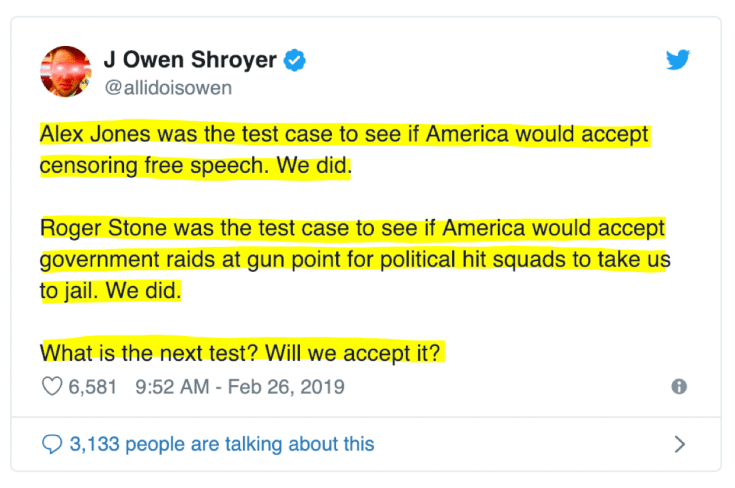

Surely it is entirely a coincidence that a CNN reporter went around actively badgering social media outlets to ban Alex Jones, way back in August 2018, and would not stop until they all did?

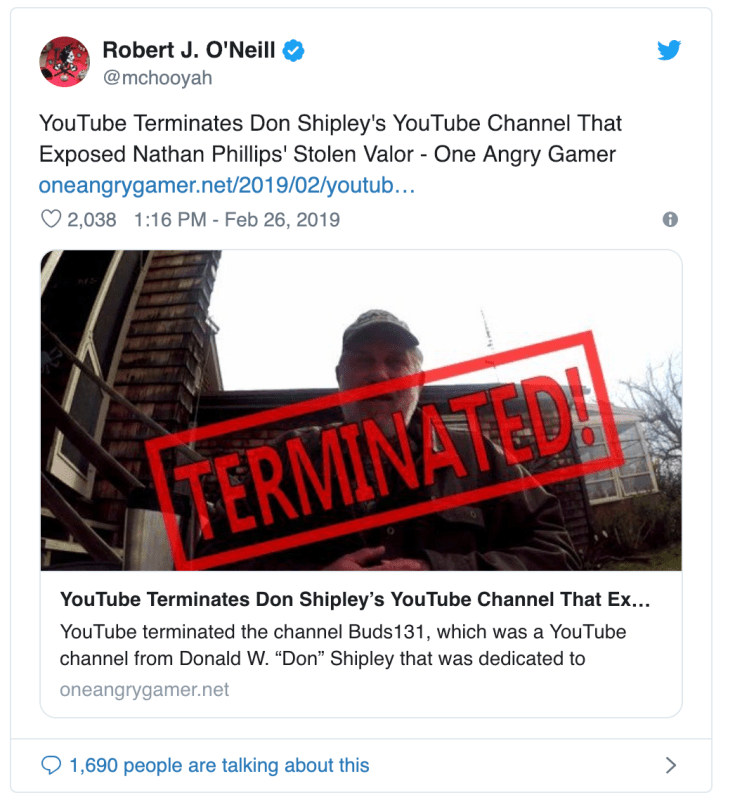

But wait, there is more! It was confirmed on Tuesday that retired Navy SEAL Don Shipley, known as a crusader against “stolen valor,” got his YouTube channel deleted earlier this month. There were no details as to why, but this was right after Shipley had exposed Nathan Phillips – the Native American activist who claimed he was victimized by Kentucky high school students, in what turned out to be fake news – as falsely claiming he served in Vietnam.

Columbia University researcher Richard Hanania offered an interesting analysis a couple of weeks ago, showing that of the 22 prominent figures suspended by Twitter in recent years, 21 were supporters of President Donald Trump, and only one – Rose McGowan – was a Democrat. McGowan had clearly violated the platform’s rule against doxxing, and was reinstated after she deleted the post. Many of those 21 Trump supporters were not so lucky, getting permanent bans from the platform. So he asked:

What are the odds? Astronomical, actually – Hanania showed that conservatives would have to be four times as likely to violate Twitter rules for even a 5 percent chance of producing the 21-1 ratio. Yet those who routinely cite statistical “disparate impact” to cry racism are perfectly fine claiming there is no bias here? Really?

But [insert social media giant here] is a private company! They can do what they want! So cry the sudden champions of capitalism and deregulation, who in their previous breath claimed Trump abolishing Net Neutrality rules would break the internet. Make up your mind, folks!

In the McCarthyite atmosphere whipped up after the 2016 US presidential election, the social media that once promised unprecedented freedom of expression have turned into the tools of censorship – and not on behalf of a governing party, either, but the bipartisan political establishment united in opposition to an outsider president and anyone who dares support him, or criticize their conduct.

By the way, the “terrible dictator” Trump hasn’t lifted a finger to stop this persecution, let alone sic the IRS or the FBI on his critics.

The idea behind free speech is not that all opinions are valid, but that they ought to be debated rather than imposed by force. Another fundamental principle of western civilization is that the law ought to apply equally to everyone.

One does not have to agree with Robinson, Wohl, Shipley, Maffick, Jones – or Trump, for that matter – to realize that a world in which there is one set of rules for “us” and another for “them,” in which it doesn’t matter what is done but Who is doing it to Whom, is not a land of liberty but something quite different.

House Dems Ask For Secret Copy Of President’s Taxes…

By Hunter Walker

WASHINGTON — House Democrats have asked for a confidential copy of President Trump’s tax returns from the IRS, but obtaining them won’t be simple or fast, Rep. Don Beyer, D-Va., said during an interview on Yahoo News’ “Skullduggery” podcast. Beyer said Democrats will need a “good legal rationale” to request Trump’s financial documents, adding that he believes the questions surrounding Trump’s ties to Russia are sufficient reason to ask for the documents.

Beyer is a member of the powerful House Committee on Ways and Means, which has the power to obtain a copy of President Trump’s tax returns thanks to an obscure law that’s almost a century old.

Trump’s tax returns have been something of a holy grail for Democrats who have consistently requested the release of the documents, particularly given the questions surrounding foreign business dealings at Trump’s sprawling real estate company. Beyer predicted that his committee will ultimately be able to get their hands on Trump’s elusive financial documents. But he explained that there are several obstacles to the process.

According to Beyer, the law allows “entities in Congress” to “request the tax return of any American citizen.” He said the Joint Taxation Committee theoretically could ask for the returns, but would be unlikely to do so due to Republican control of the Senate. This leaves the Ways and Means Committee, which is led by Democrats since they won control of the House last year. While Beyer said the Democrats on the committee have “begun the process,” he said it would be slow going.

“Our chairman, Richie Neal of Springfield, Mass., is going about this in a deliberate, thoughtful way. As he says, this is a really big, important, historic thing. He doesn’t want to not do it right. He wants to make sure that he’s crossing all the t’s and dotting all the i’s,” Beyer said.

Beyer said Neal had described some details about the process to his committee colleagues.

“As I understand it, at least as he’s explained it to us, the first step with his request is that the Internal Revenue Service will share it with him as the chairman confidentially,” Beyer said of Neal. “He will then review it and decide what can be shared with the full committee, and then ultimately, what can be shared with the American people.”

Trump became the first president in decades to break with longstanding tradition and not release his returns when he won the 2016 election. Democrats have consistently questioned what information might be in the documents, particularly given the questions surrounding foreign business dealings at Trump’s sprawling real estate company. Trump, who once promised to release the information, has cited a “routine audit” as why he has declined to do so.

While he stressed that he isn’t writing legal briefs on the issue, Beyer said he saw clear grounds for the request.

“There are so many suggestions that the president’s behavior with Russia, among others, … must be inextricably linked to his financial fortune. Why else would he give Putin a pass on damn near everything from Crimea to believing his intelligence rather than our own?” he said.

Beyer also predicted that Trump’s attorneys and allies would fight the release of the president’s returns.

“There is also anticipation that the White House is going to fight back right away, that once that request goes to them there’ll be requests for injunctions,” Beyer said.

Based on that opposition, Beyer predicted that Trump’s returns will remain hidden through the 2020 election.

“I think we need to do the best we can to get them, but it has been suggested more than once that it could be tied up in courts for two years,” he said.

IRS Workers Union Threatens Tax Refund Delays…Does That Include For Illegal Immigrants?

By Patrick Howley

The union representing Internal Revenue Service (IRS) employees gave members the option to skip work during the government shutdown if they happened to be one of the 36,000 people who were recalled — some of whom were not paid, but all of whom now get back pay. Now, the IRS workers are wielding their political power the only way they know how: by making themselves even more non-essential.

Now, the union is threatening, courtesy of CNBC: delays are likely for Earned Income Tax Credit refund-receivers, or for any kind of refund that requires “human” and not “computer” labor.

The angry government bureaucrats are not yet resorting to the tactics of the mayor of San Juan, Puerto Rico, who held press conferences in front of trucks full of un-delivered supplies during a hurricane.

Trending: Kelli Ward Wins Arizona GOP Chair Seat in Upset

The IRS must address its official policy of giving tax refunds to illegal immigrants, officially ignoring the massive scam by which illegal aliens use fake Social Security numbers in the United States.

This practice is now coming under scrutiny following the revelation that Gustavo Perez Arriaga was using at least two fake Social Security numbers to live in the United States. Arriaga has been charged with the murder of California police corporal Ronil Singh. It is not known whether the IRS ever ignored Arriaga’s fake Social Security numbers directly.

Arriaga was using two fake Social Security numbers, according to available information provided by a source close to law enforcement: 537-89-0142 and 667-28-2314.

Arriaga lived in the United States long enough to rack up multiple arrests for impaired driving. Arriaga was officially wanted for four years, but ICE officers had no contact with him prior to Corporal Singh’s shooting. Stanislaus County sheriff Adam Christianson blames the lack of contact with ICE on sanctuary laws, saying at a press conference that law enforcement should be able to do its job without legislative interference.

Illegal immigrants are able to pay taxes using ITIN numbers provided by the federal government. The IRS put out an official notice in June: “More than 2 million ITINs to expire this year; Renew soon to avoid refund delays.”

The Treasury Inspector General confirmed that the IRS paid out more than $4 billion in tax refunds to ITIN holders in the year 2010.

How many illegal aliens have been acknowledged by the IRS over the years, even despite warnings from the Social Security Administration that the illegal immigrants are not using actual Social Security numbers? That is a question congressional Republicans and Trump administration agencies might want to seek an answer to.

The IRS practice of excusing illegal aliens was revealed during the IRS scandal, kicked off by documented proof of the IRS improperly targeting tea party groups for politically motivated audits and other penalties.

Look at what current Trump administration director of national intelligence Dan Coats said at a hearing when he was a senator: “What we learned is that … the IRS continues to process tax returns with false W-2 information and issue refunds as if they were routine tax returns, and say that’s not really our job. We also learned the IRS ignores notifications from the Social Security Administration that a name does not match a Social Security number, and you use your own system to determine whether a number is valid,” Coats said.

Then-IRS commissioner John Koskinen excused the practice in the 2016 hearing.

“What happens in these situations is someone is using a Social Security number to get a job, but they’re filing their tax return with their [taxpayer identification number],” Koskinen said.

Koskinen admitted that “they are undocumented aliens.”

Koskinen actually said, “They’re paying taxes. It’s in everybody’s interest to have them pay the taxes they owe.”

Elizabeth Warren’s Wealth Confiscation Tax Would “Redistribute” 2.75 Trillion Dollars Over 10 Years

Authored by Michael Snyder via The Economic Collapse blog,

Elizabeth Warren is making it exceedingly clear that she is a socialist, and that is quite frightening considering the fact that she could potentially become our next president.

Unless some really big name unexpectedly enters the race, there is a decent chance that Elizabeth Warren could win the Democratic nomination in 2020. And if she ultimately won the general election, the Democrats would likely have control of both the House and the Senate during her first two years in the White House as well. So that means that the proposal that you are about to read about could actually become law in the not too distant future.

After AOC’s proposal to raise the top marginal tax rate to 70 percent received so much favorable attention, it was just a matter of time before Democratic presidential candidates started jumping on the “soak the rich” bandwagon, and the first one to strike was Elizabeth Warren.

When she announced her new proposal on Twitter, she dubbed it the “Ultra-Millionaire Tax”…

We need structural change. That’s why I’m proposing something brand new – an annual tax on the wealth of the richest Americans. I’m calling it the “Ultra-Millionaire Tax” & it applies to that tippy top 0.1% – those with a net worth of over $50M.

It would be bad enough if this was just a one-time tax on wealth.

But it isn’t.

Please note the use of the word “annual” in Warren’s tweet. That means that the rich would keep getting hit with this tax year after year after year.

Those with more than 50 million dollars in assets would pay a 2 percent tax each year, and those with more than a billion dollars in assets would pay 3 percent each year…

The Post reported that Warren has been advised by Saez and Gabriel Zucman, left-leaning economists affiliated with the University of California, Berkeley, on a deal that would levy a 2 percent wealth tax on Americans with $50 million-plus in assets. For Americans with assets above $1 billion, that tax rate would increase to 3 percent.

The newspaper, citing a person familiar with the plan, reported that Warren’s plan would try to counter tax evasion by boosting funding for the IRS, and by levying a one-time tax penalty on people with more than $50 million who try to renounce their U.S. citizenship. It would also require that a certain number of people who pay the wealth tax be subject to annual audits, the Post reported.

3 percent may not sound like a lot to many of you. But over the course of a couple of decades many families could have their fortunes almost completely wiped out by this wealth confiscation tax.

According to economist Emmanuel Saez, this new tax would be imposed upon approximately 75,000 families and would raise 2.75 trillion dollars over 10 years.

Clearly this is a move by Warren to appeal to the progressive wing of the Democratic Party. I really like how Zero Hedge made this point…

Elizabeth Warren has never been a friend to the wealthy. But in the age of Bernie Sanders and Alexandria Ocasio-Cortez, merely advocating for “holding the rich accountable” simply doesn’t penetrate like it did back in 2008. And that’s because, on the left flank of the Democratic Party, you’re not really a progressive unless you believe that the existence of billionaires is a policy error.

And surprisingly, there is actually a lot of public support for such a proposal. In fact, a recent Fox News poll found that Americans overwhelmingly support soaking the rich…

Voters support tax increases on families making over $10 million annually by a 46-point margin (70 percent favor-24 percent oppose), and support a hike on those making over $1 million by 36 points (65-29 percent).

There is less support for a broader tax increase: 44 percent favor raising rates on those with income over $250,000, and a small minority, 13 percent, approves of an increase on all Americans.

Of course so much depends on how a survey is worded. For example, I would be willing to bet that a survey would show that well over 50 percent of all Americans would back my proposal to abolish the income tax completely.

Over the coming months, Democratic presidential contenders are going to be continuously trying to one up each other with their promises to tax the rich and give out free stuff. By the end, someone out there may even be promising to give free rides to the Moon to everyone.

But if Elizabeth Warren really wants to be considered a serious contender, she needs to eliminate the ridiculous gaffes that have plagued her in the past. For instance, she recently claimed that we have “two co-equal branches of government”…

Freshman Rep. Alexandria Ocasio-Cortez, D-N.Y., already has declared that the government has “three chambers of Congress,” the House, the Senate and the presidency.

Now, Sen. Elizabeth Warren, D-Mass., has claimed on Twitter that the government has “two co-equal branches of government, the president of the United States and Congress.”

“The Notorious RBG (Supreme Court Justice Ruth Ginsburg) is gonna be ticked off that she’s been forgotten again,” said a post on the Twitter news-aggregating site Twitchy.

And there is certainly no excuse for such a gaffe, because she used to be a law professor.

In the end, it is difficult to understand why so many Americans seem to want to march down the road toward socialism. Because as President Trump has noted, Venezuela has shown us where that road leads…

“We’re looking at Venezuela, it’s a very sad situation,” Trump told reporters. “That was the richest state in all of that area, that’s a big beautiful area, and by far the richest — and now it’s one of the poorest places in the world. That’s what socialism gets you, when they want to raise your taxes to 70 percent.”

He added: “You know, it’s interesting, I’ve been watching our opponents — our future opponents talk about 70 percent. No. 1, they can’t do it for 70 percent, it’s got to be probably twice that number. But, maybe more importantly what happens is you really have to study what’s happened to Venezuela. It’s a very, very sad situation.”

Unfortunately, political proposals don’t have to actually make sense, and right now Elizabeth Warren is doing all that she can to win the progressive vote.